When temperatures began to plummet on March 1, 2019, Cascadia’s hydropower reservoirs sat at record low levels following weak fall rains and an exceptionally cold winter. Mechanical trouble had halved power output from the Centralia coal-fired power plant — the largest generator between Seattle and Portland. The low-pressure weather system was crimping generation from Cascadia’s wind farms. And maintenance work on lines in Los Angeles limited the amount of power that could flow north from generators in the Southwest.

Utilities appealed to citizens to conserve energy. Industries cut back as power prices spiked. And the grid held.

Utility officials call it a near miss, and a sign of a new normal. They note that over the past 12 months, extreme weather and technical glitches have resulted in rolling blackouts in California and Texas. “We really had a very close call,” says Scott Bolton, senior vice president for transmission development at Portland-based PacifiCorp.

A postmortem of Cascadia’s 2019 deep chill concurred, warning that climate change and the shift from fossil fuels to renewable energy are straining the grid — and Cascadia must be prepared.

“Future events could have direct impacts to the reliability of the bulk power system,” concluded an assessment by the Western Electricity Coordinating Council, the utility consortium that oversees reliability for the interconnected transmission network west of the Rockies.

This story was first published by InvestigateWest on Aug. 18, 2021. It is part of InvestigateWest's ongoing series Getting to Zero: Decarbonizing Cascadia.

Sharing renewable electricity across long distances is among the most cost-effective strategies for slashing carbon emissions, as InvestigateWest reported in April. Longer power lines optimized via centralized control centers increase grid flexibility to reliably carry high levels of both wind and solar power.

With a more robust network, utilities could tap a greater diversity of power sources. When inconvenient weather zaps Cascadia’s power supply, for example, utilities could import electricity from outside the meteorological trouble zone — maybe solar power from the Southwest or wind power from Montana and Wyoming. And, when the tables turn, Cascadia could return the favor by exporting its solar, wind and water power.

A bigger grid isn’t the only way to boost electricity’s reliability. Giant battery arrays on the high-voltage grid or smaller packs charged from rooftop solar panels could keep things running for several hours — perhaps even a full day if battery prices continue to fall. Hydrogen gas produced from clean electricity and stored locally also can back up the power grid.

Even diehard advocates for an expanded grid now agree that local energy upgrades will be crucial. With that acknowledgment, there’s also growing awareness that expanding the grid represents a major challenge that requires immediate action. Yet it’s common for such grid expansion projects to be delayed for a decade or more by such perennial hurdles as community opposition to new power lines and interstate disputes over who should pay for new lines.

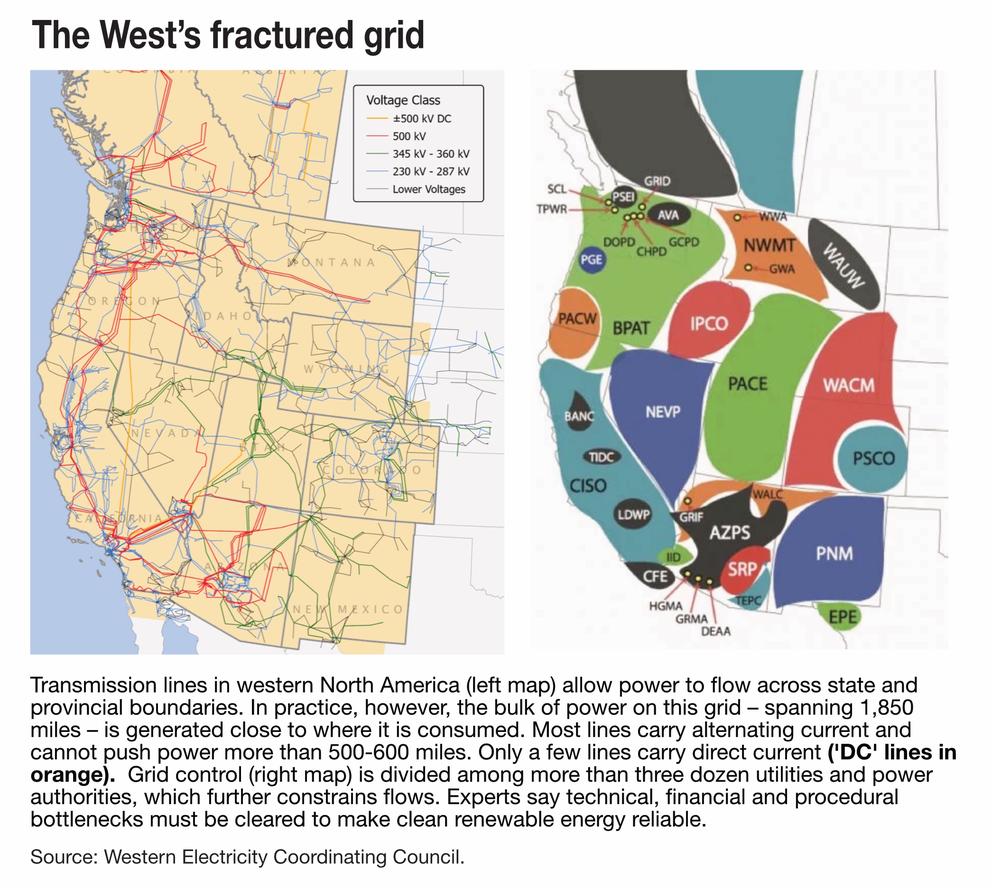

The politics of grid expansion are particularly troublesome in the West, where mechanisms for coordinating grid operation and development remain both scattershot and underdeveloped.

In most of the United States and parts of Canada, utilities allow neutral grid operators and regional markets to control which power plants operate and when and where lines get built. Such optimized systems can provide electricity at lower overall costs. They also identify where new lines are most needed and spread the resulting costs among all of the utilities and states that benefit.

West of the Rockies, the power sector remains dominated by vertically integrated monopolies. Although an independent grid operator manages most of California’s electricity, control everywhere else rests with 37 public and private utilities, including 14 within British Columbia, Washington and Oregon alone.

Cascadia needs a more coordinated Western grid to accelerate both local wind and solar installations, and to expand access to imported renewable energy, says Spencer Gray, who runs the Portland-based Northwest & Intermountain Power Producers Coalition. The group’s members include most of the Northwest’s renewable energy developers.

“It’s crazy to go into a decarbonized future still treating each state or each utility as a little island unto itself,” Gray says.

Several attempts to shift the dynamic in the West have failed over the past 20 years, but today there is renewed hope. The U.S. Senate approved a bipartisan infrastructure bill this month with provisions to encourage centralized operations and facilitate line approval and financing.

And Western utilities have gained experience with open power markets via a limited exchange launched in 2014 by PacifiCorp and the agency that operates California’s grid. Although their Western Energy Imbalance Market trades only last-minute electricity surpluses — mostly renewable energy that would otherwise go to waste — as of last month, it had saved consumers a cool $1.4 billion.

Most Western utilities have joined, and four more, including Spokane-based Avista, Tacoma Power and the federal Bonneville Power Administration, plan to sign on next spring.

To explore why a coordinated grid is a priority for Cascadia’s transition to renewable energy and the challenges to build it, InvestigateWest sought perspectives from an industry representative, a renewable energy advocate and a former British Columbia power trader who now teaches energy economics and climate policy.

Utility transmission leader:

Managing energy politics

Scott Bolton says he’s the lone liberal arts major in a utility’s transmission department — usually the exclusive domain of electrical engineers. But his posting is no accident. Modernizing the grid is much more than a technical challenge, especially in PacifiCorp’s expansive territory. “We have a six-state system, and we have three of the bluest of the ‘blue’ states and three of the reddest of the ‘red’ states,” Bolton says.

As state and industry negotiators work in several forums to unify the power sector, wild weather and political disagreements associated with climate change continue to foment tensions across the West. Guiding grid developments in states as politically diverse as Oregon, Washington and Wyoming requires the savvy that the political science major’s government experience provides.

State politicians naturally “think local.” For example, pressure to avoid a repeat of August 2020’s brief, yet politically embarrassing rolling blackouts, prompted California’s grid operator to adopt a California-first policy that could block urgent power flows to other Western states and provinces. The move, however, inflamed distrust in other states that has hamstrung the California Independent System Operator’s effort to spearhead a full-service Western power market.

Closer to home for PacifiCorp, tensions between pro-coal Montana and Wyoming and anti-coal Oregon and Washington threaten to delay development of the West’s cheap and reliable wind energy.

British Columbia's Site C hydropower project could increase grid flexibility across the West — if it's completed and allowed to operate. Provincial utility BC Hydro is erecting the project's dam on unstable ground and faces a legal challenge from northeastern British Columbia’s West Moberly First Nations. In 2018, natural gas drilling nearby sparked a magnitude 4.6 earthquake, forcing evacuation of the construction site. (BC Hydro)

PacifiCorp is in the thick of it. Along with other energy firms in Warren Buffett’s investment empire, PacifiCorp is expanding renewable generation and shuttering coal-fired power plants. In the works are new wind farms in Wyoming and new lines to share their output with Cascadia.

In April, the grid advocacy group Americans for a Clean Energy Grid rated PacifiCorp’s projects as crucial for decarbonization. The Arlington, Virginia–based group included the projects on a list of 22 “shovel-ready” transmission developments across the United States that could boost wind and solar generation by nearly 50%.

Grid expansions are crucial for both Cascadia’s decarbonization and its energy reliability, Bolton says. Wind in Wyoming, for instance, blows stronger and more often — and more frequently aligns with surging winter power demand — than wind in Oregon and Washington’s Columbia Gorge. “You get almost double the energy,” says Bolton.

Federal politicians are working to accelerate grid expansion. Gray worked with U.S. Sen. Maria Cantwell, D-Washington, on a proposal to help transmission developers get private financing for their projects. Their plan would empower the U.S. Department of Energy to sign up for rights to a proposed or expanded line, thereby encouraging utilities to join in.

A $2.5 billion “transmission facilitation fund” based on their proposal is part of the Senate’s $550 billion infrastructure bill, which must now pass the House.

Meanwhile, Bolton says proposed legislation from U.S. Sen. Ron Wyden, D-Oregon, to extend federal tax breaks to transmission projects could have even greater impact. That measure could pass as part of a $3.5 trillion, Democrat-driven spending and policy package.

But not everyone in Cascadia welcomes Bolton’s pro-transmission pitch. Communities and conservationists are fighting a link between eastern Oregon and Idaho, for example. They accuse Idaho Power, PacifiCorp’s partner on the project, of trying to siphon off Cascadia’s renewable energy and degrading views along the historic Oregon Trail.

Critics in coal-rich states, meanwhile, are riled by Oregon and Washington mandates to phase out imports of coal-generated power.

The way to transcend these political divisions, says Bolton, is to deliver cheaper power to all. He notes the “happy coincidence” that adding renewable energy and cutting the use of fossil fuels now also reduce costs.

“People care about their local economies, they care about jobs, they care about their belief systems when it comes to the politics around climate,” says Bolton. “But at the end of the day, they also like having a little extra walking-around money.”

Renewable energy advocate:

On utilities and the greater good

Nicole Hughes’ biggest challenge is the narrow and disjointed thinking by some utilities and the state regulators that oversee them.

Hughes runs Renewable Northwest, a coalition of energy professionals, ratepayer advocates and environmental groups pushing for renewable energy deployment in Oregon, Washington, Idaho and Montana. And to her, the blackouts that darkened Texas in February demonstrated the importance of sharing power among regions.

Texas operates its own grid and has only weak transmission connections to the adjoining Western, Eastern and Mexican grids. The result, she says, was that Texas couldn’t tap outside help when extreme cold shut down dozens of gas, coal, wind and nuclear power plants in February. Hundreds of people died when heaters turned off.

Her first focus for Cascadia’s grid is repurposing and expanding the high-voltage lines already in place. Take, for example, the line that links the Colstrip, Montana, coal-fired power plant to the plant’s four co-owners serving Washington and Oregon: PacifiCorp, Portland General Electric, Avista and Bellevue–based Puget Sound Energy. Those utilities all anticipate that their units of the Colstrip plant will shut down between 2027 and 2030.

Renewable Northwest eagerly awaits retirement of the Colstrip plant so that its transmission line to Washington can be repurposed to carry Montana wind power. But Puget Sound Energy put that future in doubt in early 2020 when it requested permission from Washington state regulators to sell its shares in Colstrip and the power line to NorthWestern Energy, a Montana utility with a weaker commitment to climate action.

Puget Sound Energy priced its transmission asset at $1.725 million — bargain-basement pricing, according to a national transmission expert hired by Renewable Northwest and the Seattle-based NW Energy Coalition. The expert, Michael Goggin, testified before the Washington Utilities and Transportation Commission that PSE’s asset was worth at least $342 million to Washington ratepayers.

Goggin cited PSE’s own calculations, which indicate that the Montana wind power carried by the line generally would be cheaper and more reliable — and more than 13 times more likely to be available when Cascadia really needs it.

Ultimately, commission staff advised the commissioners to reject the sale, and the deal with NorthWestern fell apart.

A PSE spokesperson told InvestigateWest, via email last month, that the sale would have sped up the elimination of coal-fired power from its supply. The spokesperson called the transmission line “a valuable asset to PSE and our customers” as the utility “works to transition to a clean energy future.”

Hughes, meanwhile, expects to be back in front of the commission again. “We anticipate having this fight over and over again, every time a utility gets out of Colstrip,” Hughes says.

Hughes says some new transmission lines are needed — and likely will be included in the projects planned by PacifiCorp. And building them may be easier in the future. Last year, Northwest utilities launched a consortium, NorthernGrid, to collaboratively plan grid expansions.

Still, Hughes cautions against planning more new lines before the West has a regional market — one in which states and stakeholders beyond utilities are involved. She argues that such a market is needed to expose and unlock the full potential of the existing grid.

One untapped opportunity Hughes points to is the historic express line linking Cascadia and Southern California, known as the Pacific DC Intertie. Fees imposed by its utility owners make importing excess solar power from California pricey. As a result, some solar power that could help Cascadia reduce its use of natural gas and coal gets turned off instead.

“Instead of just buying something new, we need to figure out if there’s something we can reuse. We’re not very good at that in this country,” Hughes says.

Energy economist:

Sharing British Columbia’s flexibility

Blake Shaffer spent seven years turning a profit for British Columbia as an electricity trader for provincial utility BC Hydro. As an academic, he focuses on the role that power trading can play in decarbonizing economies. In practice, says the University of Calgary economics professor, power trading’s moneymaking and climate action opportunities increasingly align.

He points to Cascadia’s hydropower — especially British Columbia’s — and argues that it has a special and lucrative role to play in helping utilities across the West slash reliance on coal- and gas-fired electricity.

Hydropower reservoirs are essentially giant batteries, and British Columbia has the West’s biggest by far. The W.A.C. Bennett Dam on the Peace River in northeastern British Columbia impounds 74 cubic kilometers (about 60 million acre-feet) of water, which is roughly twice as much as Hoover Dam and six times more than Washington’s Grand Coulee Dam.

Volumes like that give the province unusual flexibility, says Shaffer. Its huge hydropower reservoirs smooth out seasonal or annual fluctuations in water supply, making British Columbia less vulnerable to low-water years that stress states like Washington and California. In recent years, British Columbia also has earned extra revenue by tapping its flexible hydropower to help smooth out the supply of electricity on the Western grid.

Here’s how it works: BC Hydro ramps up its turbines and sends power south when the Western grids’ power supplies are tight — often when wind and solar generation are in short supply. It then cuts back its turbines and uses imported power to meet some of its local demand when electricity is abundant — often when winds are strong and sunny days are activating millions of solar panels.

“B.C. doesn’t have massive surplus of hydropower to export. In fact, they’re often net importers. But they do have flexibility as to when they deploy their hydropower,” Shaffer says.

British Columbia’s electrical arbitrage offers its neighbors an alternative to turning on fossil-fueled generators, which currently are the leading source of flexibility in the West. And it can sustain the power supply far longer than other low-carbon sources of flexibility. Even the largest lithium battery installations can discharge for hours only, whereas BC Hydro can usually continue exporting for days or weeks.

Powerex Corp., BC Hydro’s import/export arm, turns a tidy profit by trading electricity. Over the past five years, Powerex earned an average of $260 million more annually on its power sales than it paid for imports.

Shaffer says BC Hydro is boosting its generating capacity and, thus, the flexibility of its supply. The utility is adding turbines at existing hydro dams and building a new hydropower dam on the Peace River, although the structurally troubled Site C hydropower project remains controversial.

The West will need as much flexibility as it can get in the years ahead. As targets for greenhouse gas reduction tighten, it will be harder for utilities to use their fossil-fired power plants. At the same time, peak electricity demand is expected to increase as home heating, cars and other energy-consuming equipment plug in to the grid.

If the province wants to use its expanded hydropower to add flexibility to the Western grid, it will need more cross-border transmission capacity.

Cantwell slipped another provision into the Senate’s bipartisan infrastructure bill that would authorize federal funding for power lines that boost cross-border flows between British Columbia and the U.S. But there’s a catch: The funds are contingent on Canada accepting less favorable terms under the 1964 Columbia River Treaty, which is unpopular with some U.S. politicians and currently under renegotiation.

Shaffer says added cross-border transmission is likely to pay off for both sides. He points to recent work by researchers at the Massachusetts Institute of Technology who ran computer models to explore the value of comparable exchanges between Hydro-Québec’s big reservoirs and the northeastern United States.

In MIT’s simulation, Quebec and New England traded increasing volumes of energy back and forth as researchers programmed in more transmission between the two jurisdictions. As trading increased, good things happened. Carbon pollution and energy costs fell, and electrification of home heating and vehicles accelerated. The benefits continued to grow with a doubling, tripling — even quintupling — of the transmission capacity.

Conjuring this electrical symbiosis may take years. Proposed power lines from Quebec south are frequently hamstrung by opposition from local communities, environmentalists, Indigenous activists and state regulators.

“Transmission doesn’t get discussed enough,” a clearly frustrated Shaffer says. This in spite of a growing pile of studies from energy experts showing that transmission is a crucial ingredient in the transition to renewable energy. As Shaffer puts it: “We’re all kicking and screaming and saying this is a big part of the solution if we’re going to decarbonize.”