The new City Council majority has expressed more interest in finding “efficiencies” and “redundancies” to cut from the budget than the old majority’s preference to impose new or expanded taxes. But many Councilmembers and staff say it’s going to take a combination of approaches to close that gap.

The budget deficit stems primarily from continued pandemic fallout: tax revenues that haven’t fully recovered, high inflation and the creation of pandemic-era programs and services that continued after the one-time federal money funding them ran out.

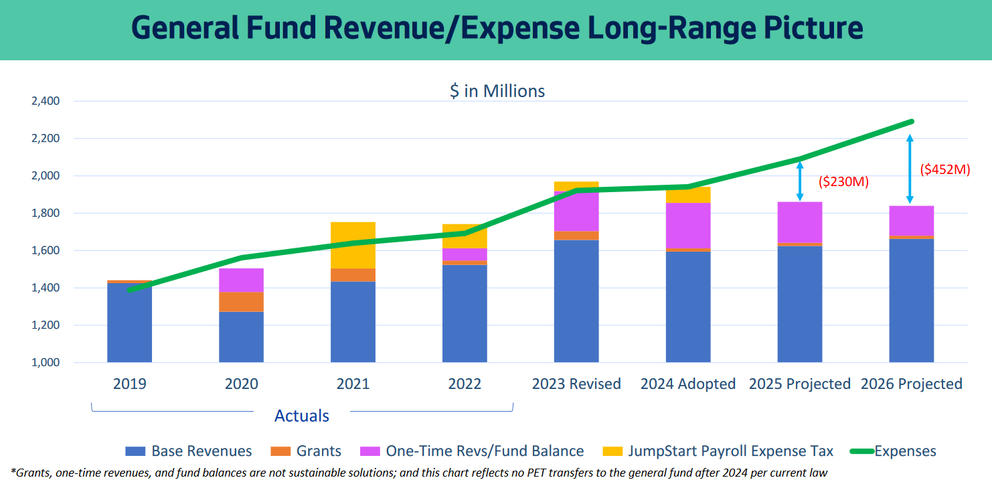

For perspective, $230 million is only about 3% of the total $7.9 billion city budget, but nearly 14% of the city’s $1.7B general fund, the piece of the budget the mayor and City Council have the most leeway to change. Another way of looking at it: $230 million is more than the combined 2024 budgets of the Office of Arts and Culture, the Office of Education and Early Learning and Seattle Public Libraries, so the deficit’s potential impact isn’t insignificant.

Seattle is legally required to balance its annual budgets, but has relatively few tools with which to do so. City officials can cut staffing, programs and services; they can loosen restrictions on how certain taxes such as the Jumpstart payroll expense tax can be spent; and they can increase existing taxes or create new ones.

On the campaign trail, the five newly elected Councilmembers, Joy Hollingsworth, Bob Kettle, Cathy Moore, Maritza Rivera and Rob Saka, all promised to perform a deep audit of the city budget before considering any new taxes. Council appointee Tanya Woo campaigned on the same promise.

The realities of combing through every line of a nearly-$8 billion budget before the city finalizes its 2025 budget this November have seemingly set in for some Councilmembers. Moore, Rivera and Saka did not respond to requests for interviews about the audit idea, and Kettle and Hollingsworth canceled scheduled interviews. But Councilmembers have discussed their budget ideas in recent Council meetings.

“Ideally, I’d like to have an across-the-board auditing of the entire city budget. But I am mindful that that is very costly and a very time-intensive activity. It’s not practical or feasible this year,” said Saka at a Feb. 5 Council briefing. Instead, he wants to focus on auditing the city’s homelessness spending. At the same meeting, Rivera similarly expressed a desire for an audit, but said it’s not practical.

Though campaign promises to fully audit the budget won’t be fulfilled this year, the City Budget Office and Council staff are taking a new approach to writing the 2025 budget, including providing deeper analysis of current spending and requiring department heads to start from scratch when proposing budgets to Mayor Bruce Harrell. This “zero-based budgeting” approach is much more time-consuming than creating a budget based on the previous year’s outline.

A different approach to budget writing

The city’s standard budget process begins with the Mayor setting guidelines and department heads making budget proposals. The City Budget Office then finalizes a proposal from the Mayor that’s sent to the Council in September. Then the Council makes amendments and votes to finalize the whole thing around Thanksgiving.

Though the city’s budget is nearly $8 billion, most of the annual tinkering happens within the $1.7 billion general fund. Many of the city’s revenue sources, such as utilities fees, gas taxes and voter-approved levies for housing and transportation, have tight restrictions on how they can be spent. Others, such as the Sweetened Beverage Tax and the Jumpstart Payroll Expense Tax, have Council-imposed restrictions.

In a typical year, department heads will build off the previous year’s budget and make adjustments as necessary — say, a request for more money to increase staff or a plan to reduce the budget by cutting unfilled staff vacancies.

City Budget Office director Julie Dingley said that this year, department heads will be starting much closer to scratch in their budget proposals. In a Feb. 21 presentation to the City Council, she said that while the city doesn’t have the technology to do true “zero-based budgeting,” in which they build each budget from the ground up regardless of prior spending, they’re asking directors to get as close to that as possible.

On the City Council side, the budget process will also look a little different this year. For one, the Council isn’t waiting until September to get started. Councilmember Dan Strauss, who chairs the Finance Committee and will lead the Council’s budget work, said he plans to do significantly more review of past budgets to help his colleagues better prepare to make cuts and amendments to the Mayor’s 2025 budget proposal.

With that, the Council’s central staff is preparing several reviews they don’t typically do as part of their budget work. Central staff budget lead Ally Pennucci said the Council usually gets only a high-level summary of departmental budget changes, but this year central staff will also produce a deeper analysis that looks at department programs and lines of business.

Central staff are also putting together an assessment of how city spending has increased in recent years, comparing the mismatch between revenues and expenditures and looking at spending by other similar-sized cities to benchmark Seattle’s budget priorities. On that final piece, Noble’s Feb. 5 presentation noted it’s “not clear how much value [benchmarking] would actually provide.”

How we got here

Seattle’s $230 million gap between tax revenue and spending comes from a combination of factors, many of which grew out of the pandemic. Several of the city’s tax revenues have not returned to pre-pandemic levels, including the gas tax, the commercial parking tax and the real estate excise tax, one collected after the sale of a residential or commercial property. On top of that, the high inflation that’s followed the pandemic is hurting the city’s buying power.

Some pandemic-era programs have continued, requiring general-fund dollars to replace federal funds. They include ongoing operations of expanded homelessness shelters and the Clean Cities program, which cleans up trash, debris and graffiti from parks, greenspaces and city streets.

The city recently reached a contract agreement with the Coalition of City Unions that will provide raises to more than 7,000 city workers, and is in ongoing negotiations with the Seattle Police Officers Guild, who are also expected to get raises. These too will impact the general fund.

The city has experienced a gap between revenues and expenses every year since 2020, but was able to use federal COVID-relief funds and windfall from the Jumpstart Payroll Expense Tax to cover the gap.

Jumpstart revenues are meant to be spent only on affordable housing, economic revitalization for small businesses, the Equitable Development Initiative and Green New Deal climate programs. Though the City Council placed a restriction on Jumpstart revenues, they voted to allow one-time uses of Jumpstart to close gaps during the most recent several budget cycles. In the 2024 budget, $85.6 million of the roughly $300 million Jumpstart is projected to raise this year is being used to close a general-fund gap.

Councilmember Strauss wants to stop kicking the can down the road with one-time measures to deal with the budget deficit.

“The old ways of doing business aren’t serving us today, and we really need to get our arms around this whole thing. The opportunity here is that we get to solve this issue holistically,” said Strauss in an interview with Cascade PBS.

Cuts versus taxes versus something else

Exactly how the city plans to close its $230 million gap for the 2025 budget won’t be seen until the Mayor releases his budget in September.

Budget Director Dingley does not expect all of it to come from cuts, at least in the short term.

“We’re not going to be able to implement the full meal deal of $230 million worth of reductions as of Jan. 1 [2025],” she said in her February presentation to the Council. “Just operationally we’re not going to be able to. We’re going to have to think about one-time strategies to help stagger the implementation a little bit.”

Asked about closing the gap with cuts, Strauss told Cascade PBS, “I don’t think anyone knows that right now. And if somebody says that they know I wouldn’t believe them.”

He said the city’s deeper dive into the budget over the course of this year will determine if and where cuts can be made. But he has a few ideas. For example, the city employs arborists in both the Department of Transportation and Parks and Recreation. “Sometimes redundancy is helpful, so the power doesn’t go out. And sometimes redundancy is not helpful when you have arborists in [multiple] departments,” he said during the Feb. 21 committee meeting.

Strauss also said the city is leasing office space in buildings it doesn’t own and might no longer need. While it would cost money in the short term to move people, it would save money in the long term to have them in city-owned buildings.

Councilmember Kettle has expressed skepticism of earmarking Jumpstart tax revenue for specific programs rather than having it go directly into the general fund. Stopping the earmarking could open the door to using more Jumpstart revenue in 2025 and beyond to balance the budget.

Councilmember Tammy Morales worries about both cuts in the budget and the impact of redirecting Jumpstart revenue.

“We’re not going to be able to cut our way out of a $230 million deficit without cuts to public health, public safety, homelessness,” Morales told Cascade PBS. “We’re not going to be able to both cut $230 million out of the budget and continue to provide the level of service we need.”

Similarly she said, “The payroll expense tax was very deliberately created to address some of the inequity in the way we spend in the city,” and using Jumpstart revenues to fill the general fund would harm that effort.

Many Councilmembers have expressed skepticism about adopting any of the new taxes proposed by Seattle’s Revenue Stabilization Workgroup. In an opinion column for The Seattle Times, Council President Sara Nelson wrote, “We must break our reliance on new revenue (taxes) to pay our bills. That’s an unsustainable fix for the wrong problem. The real problem is spending.”